Every time you pick up a prescription for a generic pill-say, metformin for diabetes or atorvastatin for cholesterol-you’re holding the end result of a long, complex journey. It’s not just a bottle of pills. It’s a global network of factories, regulators, distributors, and negotiators working behind the scenes to make sure that medicine is safe, affordable, and ready when you need it. And yet, most people have no idea how it all works.

Where It Starts: The Raw Materials

It begins far from your local pharmacy, often in a chemical plant in India or China. About 88% of the Active Pharmaceutical Ingredients (APIs)-the actual medicine inside the pill-are made overseas. The U.S. now produces just 12% of its own APIs. These raw chemicals aren’t just mixed in a garage; they’re produced under strict conditions to meet international quality standards. A single batch of API for a common blood pressure drug might travel through multiple countries before it even reaches the U.S. border. The problem? This global setup makes the supply chain fragile. During the pandemic, when factories in India slowed down due to lockdowns, 170 different generic drugs suddenly went short in the U.S. That’s not a glitch-it’s how the system is built. The FDA has doubled its foreign inspections since 2010, but keeping up with thousands of overseas facilities is a constant challenge.Getting Approved: The FDA’s Gatekeeping Role

Once the API arrives in the U.S., it goes to a generic drug manufacturer. But they can’t just start packaging and selling. First, they must file an Abbreviated New Drug Application (ANDA) with the FDA. This isn’t a full clinical trial like brand-name drugs need. Instead, they prove their version works the same way as the original. It has to release the same amount of medicine at the same rate in the body. It has to be bioequivalent. This step is what makes generics affordable. No need to repeat expensive trials. But the FDA doesn’t just rubber-stamp applications. They inspect the manufacturing plant-sometimes unannounced. If the facility fails a GMP (Good Manufacturing Practice) audit, the entire batch gets rejected. One failed inspection can delay a drug’s launch by months. And with over 90% of prescriptions now filled with generics, the pressure to keep approvals moving is huge.Manufacturing: Bulk, Not Custom

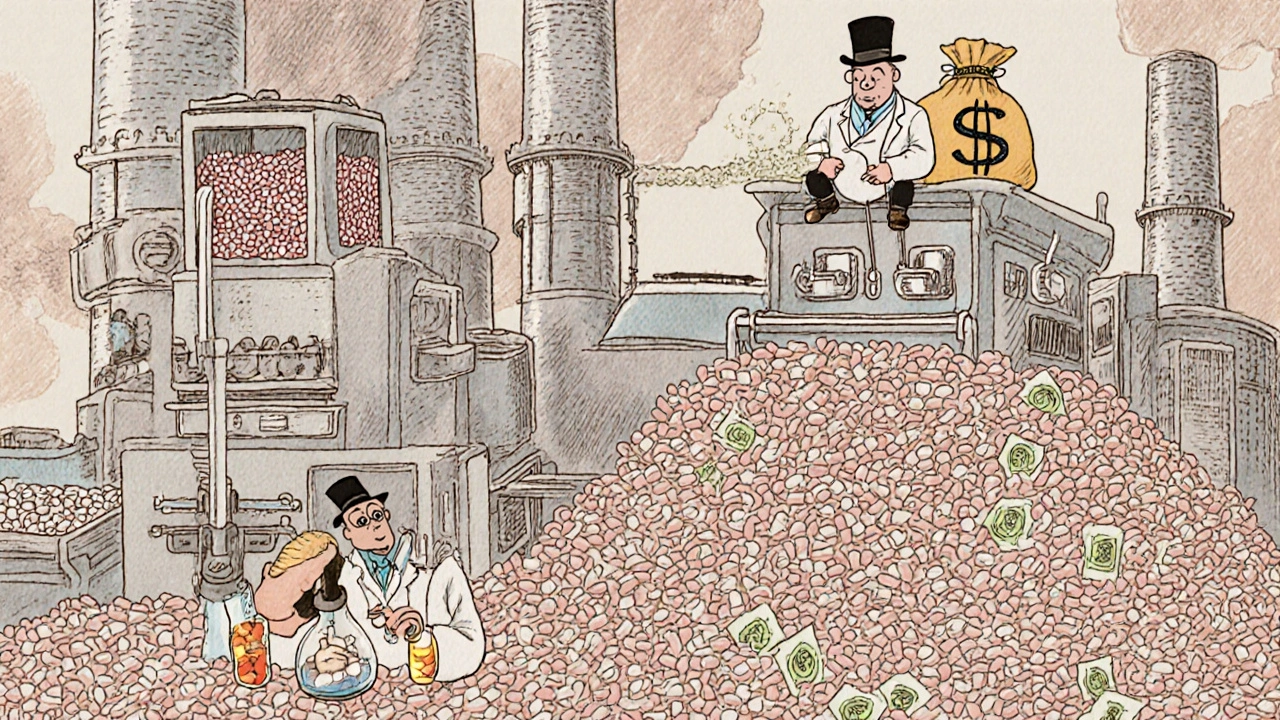

After approval, the real volume kicks in. Generic manufacturers don’t make small batches. They churn out millions of pills at a time. A single production line might make 50 million 10mg tablets of lisinopril in a month. Quality control happens at every stage: raw material testing, in-process checks, final product analysis. Each batch gets tested for purity, potency, and stability. But here’s the catch: margins are razor-thin. Generic manufacturers only get about 36% of the total money spent on their drugs. The rest goes to distributors, pharmacies, PBMs, and other middlemen. That’s why some companies specialize in making just one or two high-volume generics. Others get out entirely when prices drop too low. In the last five years, over 150 generic drug manufacturers have shut down or been bought out.

The Middlemen: Wholesalers and PBMs

Once the pills are made, they don’t go straight to the pharmacy. They go to wholesale distributors-companies like AmerisourceBergen, McKesson, and Cardinal Health. These firms buy in massive quantities and then sell smaller amounts to pharmacies. They often offer discounts if the pharmacy pays quickly, a practice called “prompt payment discounts.” But the real power lies with Pharmacy Benefit Managers (PBMs). Three companies-CVS Caremark, OptumRX, and Express Scripts-control about 80% of this market. They don’t make drugs. They don’t sell them. They manage the money flow between insurers, pharmacies, and manufacturers. They decide which drugs are covered, what pharmacies you can use, and how much you pay at the counter. For generics, PBMs use something called Maximum Allowable Cost (MAC). This is a cap on how much they’ll reimburse the pharmacy for a specific drug. Say the MAC for 10mg lisinopril is $3.50. If the pharmacy bought it for $4.00 from the wholesaler, they lose 50 cents per pill. That’s why many independent pharmacies say MAC pricing is killing them. They’re forced to sell at a loss just to stay in the network.The Pharmacy: Where the Rubber Meets the Road

Finally, the pills land on the shelf. Pharmacies stock hundreds of generic drugs, often keeping extra inventory because shortages are common. They negotiate with wholesalers for better prices. They negotiate with PBMs to stay on preferred lists. And they deal with patients who expect the lowest price possible. Many pharmacies now use real-time data tools to track which generics are running low. If a batch of metformin gets delayed in shipping from India, they might switch to a different manufacturer’s version-same active ingredient, different brand name on the bottle. This flexibility keeps patients covered, but it adds complexity. And then there’s the pricing mystery. A patient might pay $4 at the pharmacy, but that’s not what the pharmacy paid. They might have bought it for $1.20. The PBM took a cut. The wholesaler took a cut. The manufacturer barely broke even. No one knows the full chain of costs. As Harvard’s Dr. Aaron Kesselheim put it: “It’s impossible to know how much a generic drug really costs.”

Comments

Gus Fosarolli

So let me get this straight - we rely on factories in India and China to make our life-saving meds, but if one of them sneezes, we’re left scrambling for metformin? 🤦♂️

And don’t even get me started on PBMs acting like middlemen vampires sucking the life out of pharmacies. The system’s not broken - it’s just designed by people who think ‘profit’ is a verb.

Also, why does my $4 generic cost the pharmacy $1.20 but I’m still getting billed like I’m buying a Rolex? Someone’s making bank and it ain’t the guy who actually made the pill.

November 27, 2025 at 15:33

Evelyn Shaller-Auslander

my pharmacy told me the lisinopril i got last week was from a diff maker same stuff but diff color… i asked why and they just shrugged. kinda scary how little we know

November 27, 2025 at 22:59

ABHISHEK NAHARIA

It is a disgrace that America, a nation of innovation and strength, has outsourced its pharmaceutical sovereignty to foreign lands. The very foundation of public health is being held hostage by foreign factories. India and China do not have our moral compass. They do not care for our children. This is not capitalism - this is surrender.

Our FDA inspections are a farce. How can a bureaucrat in Virginia truly understand the conditions of a plant in Hyderabad? We must nationalize API production. Or better yet - build our own factories. With American steel. American workers. American pride.

November 28, 2025 at 12:15

Hardik Malhan

API supply chain fragmentation is a systemic risk multiplier. The concentration of manufacturing in a few geographies creates single points of failure. GMP non-compliance events are non-linear in impact. MAC pricing protocols exacerbate margin compression at the retail tier leading to supply disincentivization.

Blockchain traceability is the only viable path forward. End-to-end serialization reduces opacity. Need to move beyond legacy EDI systems. Also, PBMs are rent-seekers. Pure and simple.

November 29, 2025 at 08:25

Casey Nicole

OMG I just realized I’ve been taking generic atorvastatin for 7 years and I have NO IDEA who made it or where it came from 😭

Like… I’m literally swallowing mystery pills from a country I can’t even spell. And I’m supposed to trust this? This is not healthcare. This is Russian roulette with cholesterol.

Also I hate PBMs. They’re the reason my co-pay went up $2 last month for a drug that costs 12 cents to make. #pharmaconspiracy

November 30, 2025 at 13:44

Kelsey Worth

so the system works… but like… it’s a Rube Goldberg machine made of duct tape and hope

one factory in india sneezes and suddenly my blood pressure meds are gone? cool. cool cool cool.

also why does my pharmacy look at me like i’m asking for a kidney when i ask if there’s another brand? they’re all the same. just different labels. it’s ridiculous

December 1, 2025 at 12:46

Richard Elias

You people are naive. The FDA is a joke. They inspect one plant out of 1000. They approve generics based on paperwork. You think your metformin is safe? You’re lucky if it’s even the right chemical.

And don’t get me started on India. Their labs are dirty. Their workers are underpaid. They cut corners. And we’re just supposed to swallow it? Literally.

This isn’t healthcare. It’s a global Ponzi scheme. And you’re the sucker.

December 3, 2025 at 10:45

Scott McKenzie

Just wanted to say - this is actually one of the most important things I’ve read all year. 🙏

Most people think generics = cheap = bad. But the truth? They’re saving lives and billions. The real villains are the middlemen who hide behind ‘rebates’ and ‘discounts’ that never reach patients.

If you’re reading this and you take generics - thank you. You’re helping keep healthcare affordable. And if you’re a pharmacist? You’re a hero. 💪

Also, if your pharmacy runs out - ask for another brand. Same active ingredient. Just a different label. No shame in switching.

December 4, 2025 at 00:47

Jeremy Mattocks

Let’s go deeper. The whole system is built on economies of scale - but that scale is now a vulnerability. When you have 150 manufacturers shut down in 5 years, you’re not reducing competition - you’re creating monopolies by attrition. The remaining players? They’re the ones who can afford the FDA audits, the compliance teams, the legal teams. Small guys? Gone.

And now, when one of the big 3 API makers has a quality issue? Boom. Nationwide shortage. No backup. No redundancy.

Meanwhile, PBMs are playing financial games with MAC lists like they’re trading stocks. But it’s not stocks - it’s someone’s insulin. Someone’s heart medication.

And the FDA is scrambling to approve 1000 generics a year but can’t even audit the factories fast enough. It’s like building a highway with one bulldozer while 10,000 cars are already on it.

And the kicker? We’re told this is the solution to affordability. But affordability without transparency is just exploitation dressed up as efficiency. We need real supply chain mapping. We need public oversight. We need to stop treating medicine like a commodity and start treating it like a human right. And no, blockchain won’t fix it unless we fix the incentives first.

December 4, 2025 at 14:49

Paul Baker

so like… i live in india and we make most of the world’s generics and we’re not even getting paid fairly 🤷♂️

our factories work 24/7 and still get blamed for shortages? come on

we’re not the problem. the problem is the middlemen who take 70% of the price

and yeah we have typos. i’m typing on my phone. deal with it 😎

December 5, 2025 at 22:04

Jill Ann Hays

One must consider the epistemological implications of pharmaceutical opacity. The patient is rendered an epistemic subject within a system of distributed agency wherein accountability is deliberately obfuscated by institutional layering. The MAC pricing mechanism is not merely economic - it is a form of symbolic violence against the embodied experience of chronic illness. The illusion of affordability masks a structural disenfranchisement. The FDA, as a regulatory body, functions as a legitimizing apparatus for neoliberal extraction. We are not consumers. We are data points in a supply chain designed to optimize profit, not health.

December 7, 2025 at 08:29

Mike Rothschild

My cousin works at a generic drug plant in Ohio. They make 10 million lisinopril pills a week. The whole facility runs on automation now. One guy monitors three machines.

They’re paid well. Benefits. Union. No one’s getting exploited here.

But the stuff they make? 80% gets shipped overseas to be packaged and sold back to us as ‘imported generics’.

Meanwhile, the PBM takes $2.80 off every $3.50 we pay. That’s not supply chain. That’s theft.

And the FDA? They inspect U.S. plants twice a year. India? Once every five years. That’s not oversight. That’s negligence.

December 9, 2025 at 05:38

Gus Fosarolli

Wait - so the guy who made my metformin in India got paid $0.02 per pill… and I paid $4 for it?

And the PBM pocketed $2.50?

And the pharmacy lost 50 cents?

And the FDA didn’t even visit the factory since 2021?

Then I guess I’m just a dumbass who thinks medicine should be safe and affordable.

But hey - at least my co-pay is low. 😌

December 10, 2025 at 02:20

Write a comment